Hey, welcome back to Open Scout.

Every decade or so, technology hands us something that fundamentally changes how we build companies.

The internet gave us global connectivity. Cloud infrastructure birthed the SaaS revolution. Mobile devices created the app economy and made billion-dollar companies out of garage projects.

Now? We’re watching intelligence itself become programmable.

Welcome to the era of autonomous AI agents.1

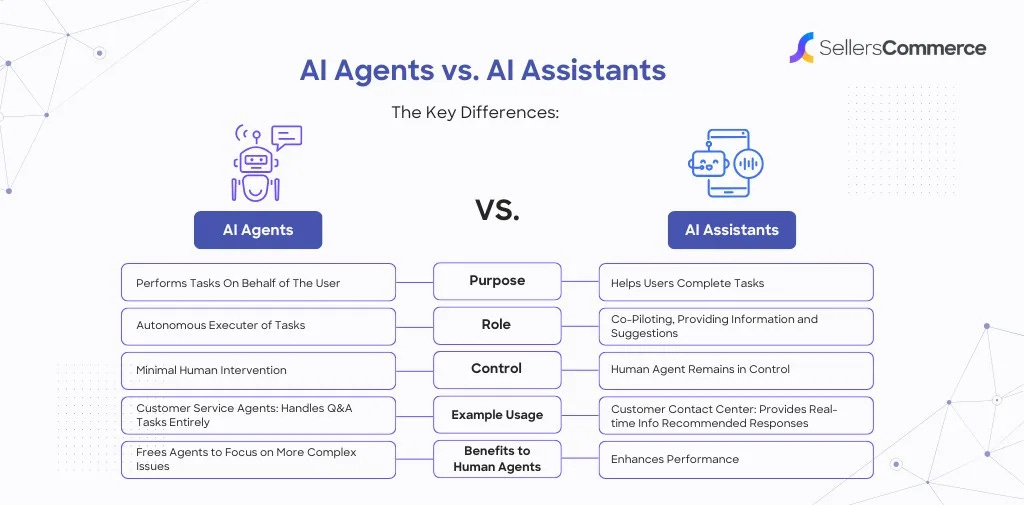

And here’s the thing: this isn’t just another feature release or incremental improvement. We’re talking about software that doesn’t wait for instructions—it pursues goals, makes decisions, and gets work done while you sleep.

Some founders will see this early and build empires. Others will watch from the sidelines wondering what happened.

Over the last several months, I’ve been diving deep into this transformation—meeting with builders pushing the boundaries, investors placing billion-dollar bets, and companies already seeing outsized returns from agent deployment.

In this piece, I’ll walk you through:

Why autonomous agents represent a platform shift as significant as cloud or mobile

How they’re already disrupting traditional software economics

Where the real money will be made (hint: it’s not where everyone’s looking)

If you’re trying to separate signal from noise in the agent space—or figure out where to focus your energy—this is your roadmap.

Before we begin... a big thank you to this week’s sponsor

The go-to debit card for instant discounts

Get instant discounts at places you already shop with a Cash App Card. It’s a debit card that works where Visa is accepted, even at ATMs. Whether it’s time for groceries, a ride to meet a friend, or something you’ve been eyeing, you’ll get access to offers that turn everyday spending into real savings.

Why you’ll love it:

Exclusive offers to save on everyday spending

No monthly or hidden fees

24/7 fraud monitoring to avoid scams before they can happen

Instant ways to lock your card if it’s ever lost or stolen

Pay over time for eligible purchases with Cash App Afterpay2

The Market Signals Are Screaming

Let me hit you with some numbers that should make you pay attention:

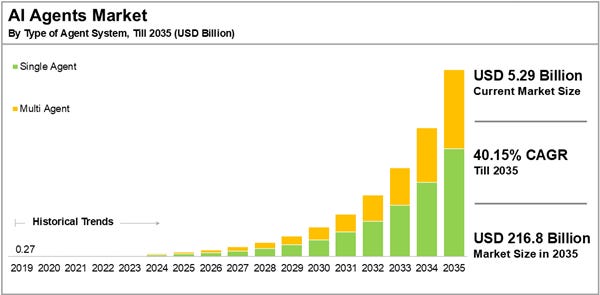

The AI agents market jumped from $5.4 billion in 2024 to an estimated $7.6 billion in 2025—and analysts project it will explode to somewhere between $47 billion and $236 billion by 2030-2034, depending on which forecast you believe.

So far in 2025, roughly $2.8 billion in venture funding has poured into AI agent startups, with projections hitting $6.7 billion by year’s end.

But here’s where it gets interesting: 88% of enterprises are already setting aside specific budgets to experiment with AI agents this year, and over 60% have moved past pilots into production or scaling phases.

This isn’t hype-driven FOMO. This is calculated deployment.

Why This Wave Feels Different

We’ve been here before with buzzwords. Remember when everything was “blockchain-enabled” or “metaverse-ready”? Those fizzled because they were solutions desperately searching for problems.

Agents are different. Here’s why:

1. They Attack a Massively Larger Budget

Traditional SaaS eats into software budgets. Agents? They’re coming for labor budgets—which are 35x larger than what companies spend on software.

Think about it: a company paying $100,000 for software might be spending $3.5 million on the people operating that software. Agents can augment or replace entire workflows, not just make them slightly more efficient.

2. The Technology Finally Works (Mostly)

Recent surveys of developers building AI applications show 99% are exploring or actively developing AI agents. That’s not just interest—that’s production-ready confidence.

Foundation models have reached a tipping point where they can reason, plan, and execute multi-step workflows with acceptable accuracy. Not perfect, but good enough to deploy with proper guardrails.

3. The Economic Model Is Compelling

Traditional SaaS charges per seat. But what happens when one agent can do the work of 10 people across different departments?

The pricing conversation shifts from “how many users?” to “what’s the business outcome worth?” That’s a fundamentally different negotiation—and a much larger deal size.

The Three Categories of Agent Adoption

Not all agents are created equal. The market is coalescing around three distinct types:

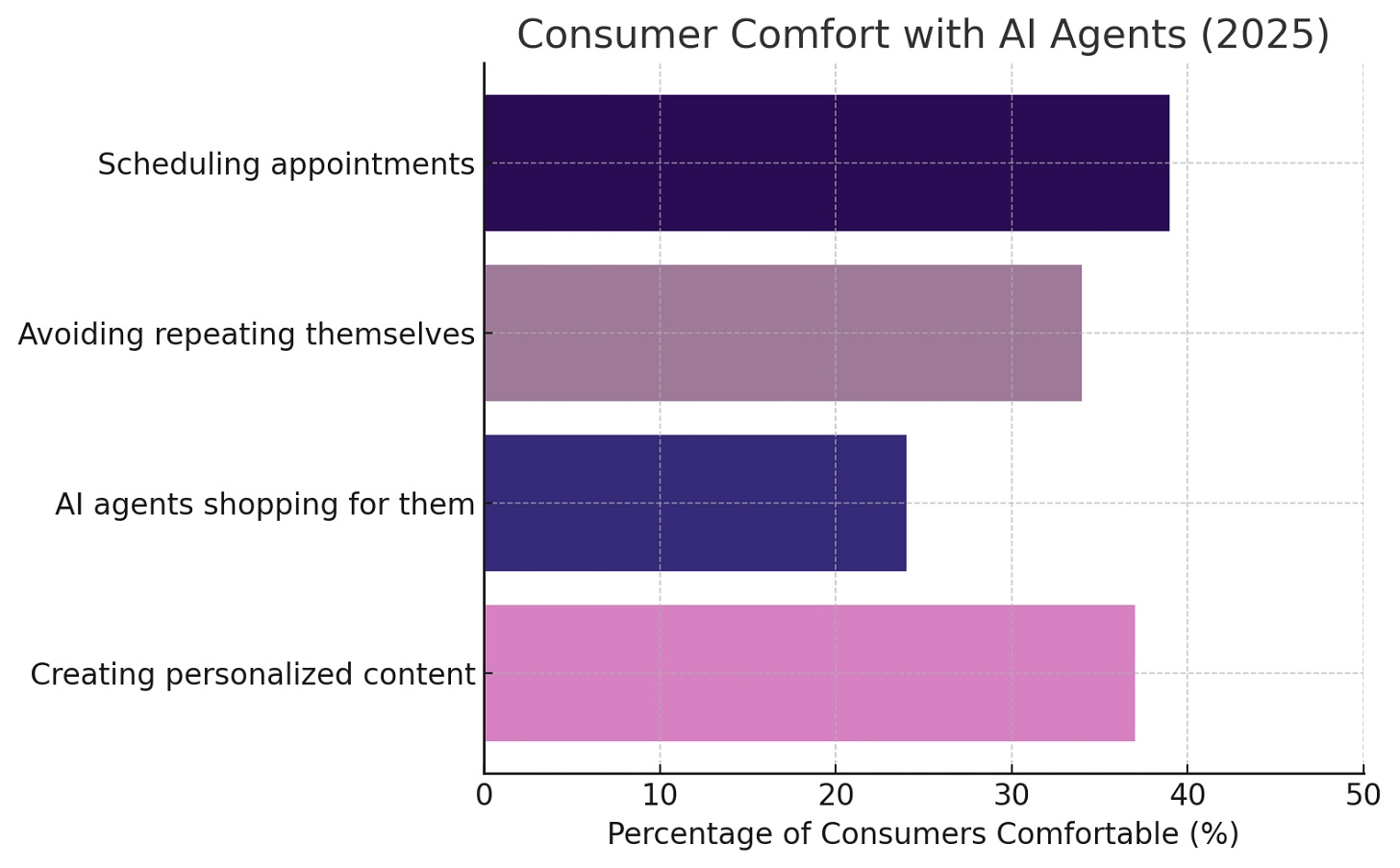

Personal Agents — Think AI assistants that manage your calendar, draft emails, and coordinate across your digital life. These are the training wheels getting consumers comfortable with autonomous behavior.

Role-Based Agents — Specialized workers for specific jobs: legal contract review, SDR outreach, financial analysis, code generation. These are seeing the fastest enterprise adoption because the ROI is crystal clear.

Company-Wide Agents — Platform-level systems that orchestrate multiple agents, manage data flows, and optimize across departments. This is where the real transformation happens—and where the biggest companies will be built.

Where the Smart Money Is Going

Seed-stage investors have deployed around $700 million into autonomous agent startups focused on enterprise applications, with particular attention on legal tech, coding assistants, and workflow automation.

But here’s the pattern I’m seeing: the infrastructure layer is necessary but commoditizing fast. Everyone’s racing to build better orchestration frameworks, memory systems, and evaluation tools. That’s table stakes.

The real value capture is happening at the application layer—specific vertical solutions that own a complete workflow and deliver measurable business outcomes.

High-Signal Investment Areas

Coding & Developer Tools — Tools like Cursor have gone from $1M to $200M in annual recurring revenue in just over a year by letting developers generate entire features through natural language. Dev tools command premium multiples because they compound productivity exponentially.

Legal & Compliance — Regulated industries are slower to adopt but offer massive moats once you build trust. Agents that navigate complex legal frameworks and compliance requirements create sustainable advantages.

Finance & Healthcare — The BFSI sector leads AI agent adoption, using autonomous systems for real-time underwriting, fraud detection, and credit analysis while maintaining regulatory compliance. Healthcare is following a similar path—slow to start, but enormous when it scales.

Customer Service & Sales — The most mature category with proven ROI. Companies are already automating 60%+ of support tickets, and the quality keeps improving.

The Valuation Landscape Is Wild

Recent analysis of 210 AI agent companies shows valuation multiples ranging from 3x revenue in lower-tier categories like PropTech and HR to 30-50x revenue for premium plays in dev tools, legal compliance, and productivity platforms.

Translation: investors are paying massive premiums for agents that embed into critical daily workflows and create switching costs.

The stage-based valuation curve is non-linear: Seed rounds average 22.7x revenue, Series A jumps to 39.1x, Series B peaks at 41x, then compresses to 26-2x at Series C before recovering at later stages.

This tells us something important: conviction comes early for the right categories. If you can prove workflow integration and stickiness in your Series A, you get rewarded. If you’re still figuring out GTM by Series C, multiples contract.

These aren’t your dad’s ED meds (Sponsor)

Erectile dysfunction (ED) medications aren’t new, but they have come a long way in recent years. No more awkward doctor’s office visits—modern ED medications can now be prescribed by medical professionals 100% online, shipped discreetly, and consumed in many ways (like chewables or mints). View Money.com’s list of the Best ED Medications and take back your love life.

Benefits of modern ED treatments:

Chewable or dissolvable options

Longer-lasting 36-hour formulas

Flexible dosing for different needs3

What Makes an Agent Company Defensible?

After studying hundreds of agent startups, the winners share common DNA:

Workflow Embedding — They don’t bolt onto existing software; they become the workflow. Think about how Cursor replaced traditional IDEs for many developers—not because it added features, but because it fundamentally changed how code gets written.

Data Moats — Agents that accumulate proprietary data through usage create compounding advantages. Every interaction makes them smarter for your specific use case.

Trust & Safety — In regulated industries, security certifications and compliance frameworks become competitive moats. Being first to prove you can operate safely at scale matters.

Integration Depth — The best agents connect deeply into enterprise systems—CRMs, ERPs, internal tools—making them progressively harder to rip out.

The Reality Check: What’s Still Hard

Let’s be honest about the challenges:

Large language models still hallucinate, and chaining multiple AI-driven steps can compound errors, especially for tasks requiring exact outputs or high-stakes decisions. Banking, healthcare, and legal applications need extensive guardrails.

Performance costs remain high—state-of-the-art models are slow and expensive when handling complex multi-agent workflows. Unit economics need constant attention.

Reliability Is Everything — One major failure can tank enterprise adoption. Unlike consumer apps where bugs are annoying, agent mistakes in production can cost millions or violate regulations.

How to Position for This Wave

Here’s what I’m telling founders:

1. Start with a wedge that proves value fast — Don’t try to boil the ocean. Pick one workflow where you can show 10x improvement in 30 days. Companies using Microsoft 365 Copilot demonstrate this—they started with email summarization and meeting notes before expanding to more complex tasks.

2. Choose your market based on data availability and tolerance for error — Early traction is happening in logical, factual domains like legal tech and coding because AI performs best there and training data is abundant. Customer service works because there’s built-in human failover.

3. Build for the human + machine model — Full autonomy is sexy, but augmentation is what’s actually getting deployed and paid for right now. Give humans oversight while the technology matures.

4. Focus obsessively on ROI metrics — Enterprises don’t care about your model’s architecture. They care about time saved, costs reduced, and revenue generated. Make these numbers impossible to ignore.

Three Predictions for the Next 18 Months

Prediction 1: Consolidation Begins — We’ll see major acquisitions as established software companies realize their products are vulnerable. Expect enterprise giants to buy agent startups to defend their installed base.

Prediction 2: Pricing Models Evolve — Per-seat SaaS pricing breaks when agents do the work of multiple people. Outcome-based pricing will become standard for agent products—you pay for results, not software access.

Prediction 3: A Breakout Consumer Agent Emerges — Right now, agents are mostly B2B. Someone will crack the consumer use case in a way that creates viral adoption—probably around personal productivity or content creation.

Act Now or Watch It Happen

Here’s the uncomfortable truth: this transition is happening whether you’re ready or not.

Traditional software companies are already losing deals to agent-first startups. Sales teams are getting replaced by AI SDRs that never sleep. Customer service departments are shrinking as agents handle tier-1 support.

The companies winning right now aren’t the ones with the best technology—they’re the ones who moved fastest to redefine what their customers expect.

If you’re building in this space, focus on:

Real business outcomes over technical sophistication

Tight workflow integration over feature breadth

Trust and reliability over speed to market

Clear ROI over ambitious roadmaps

The opportunity is massive. The window won’t stay open forever.

What are you building?

Thanks for reading.

If you enjoyed it, please forward it to a friend—it’s quick and can make a real impact. If not, you can unsubscribe below.

See you Monday—Kenneth

P.S. Interested in sponsoring next week’s issue? Shoot me an email.

Cash App is a financial services platform, not a bank. Banking services provided by Cash App’s bank partner(s). Prepaid debit cards issued by Sutton Bank, Member FDIC. See Terms and Conditions. Direct deposit, offers, discounts and overdraft coverage provided by Cash App, a Block, Inc. brand. *All states except Alabama and Texas: Afterpay is offered and managed through your Cash App account - no Afterpay account needed. Loans issued by First Electronic Bank. Alabama and Texas: Afterpay is offered and managed through your Cash App account - no Afterpay account needed. Loans issued by Square Capital, LLC.

The information provided in this email is for educational purposes only and is not intended as medical or health-related advice. The companies, products, and services featured on Money.com may not be right for everyone. Consult with a professional for individual medical or health-related advice. Prescription products require an online consultation with a healthcare provider who will determine if a prescription is appropriate. Compounded products and have not been approved by the FDA. The FDA does not verify the safety or effectiveness of compounded drugs. Restrictions apply. See website for full details and important safety information.