AI Pricing Isn’t “Set and Forget.” It’s a Moving Target.

Three weeks in, one user had cost them $847 in compute...

👋 Welcome back.

A founder I talked to last month launched with unlimited generations at $29/month. Three weeks in, one user cost them $847 in compute. They didn’t have a business model. They had a charity with a credit card processor.

Welcome to AI pricing in 2025.

For 20 years, SaaS pricing was a spreadsheet exercise. Pick a number. Add tiers. Gate features. Ship it. Marginal cost was effectively zero, so you could price on psychology: $9 looks friendly, $29 feels premium, $99 means you run a business.

Then AI showed up. Now every click costs money. Great customers cost money. Bad customers cost more. And that free trial you designed to drive signups? It’s bleeding you dry.

The founders navigating this best aren’t the ones who “got pricing right.” They’re treating pricing like a product that has to evolve weekly.

Before we begin... a big thank you to this week’s sponsor

Launch fast. Design beautifully. Build your startup on Framer — free for your first year.

First impressions matter. With Framer, early-stage founders can launch a beautiful, production-ready site in hours. No dev team, no hassle. Join hundreds of YC-backed startups who launched here and never looked back.

One year free: Save $360 with a full year of Framer Pro, free for early-stage startups.

No code, no delays: Launch a polished site in hours, not weeks, without hiring developers.

Built to grow: Scale your site from MVP to full product with CMS, analytics, and AI localization.

Join YC-backed founders: Hundreds of top startups are already building on Framer.

👉 Apply to claim your free year →1

Most AI Companies Are Losing Money

Let’s start with what nobody wants to say out loud: 73% of AI companies are still experimenting with their pricing models, testing an average of 3.2 different approaches in their first 18 months.

And the results? AI companies average 50-60% gross margins compared to 80-90% for traditional SaaS. That 30-point gap is the difference between building a defensible business and running a subsidy program funded by your last round.

Companies that stick with traditional per-seat pricing for AI products see 40% lower gross margins and 2.3x higher churn than those adopting usage or outcome-based models.

The math is unforgiving. Some analyses suggest AI companies lose nearly $40 for every dollar they make. Even OpenAI, despite generating massive revenue, continues to operate at significant losses.

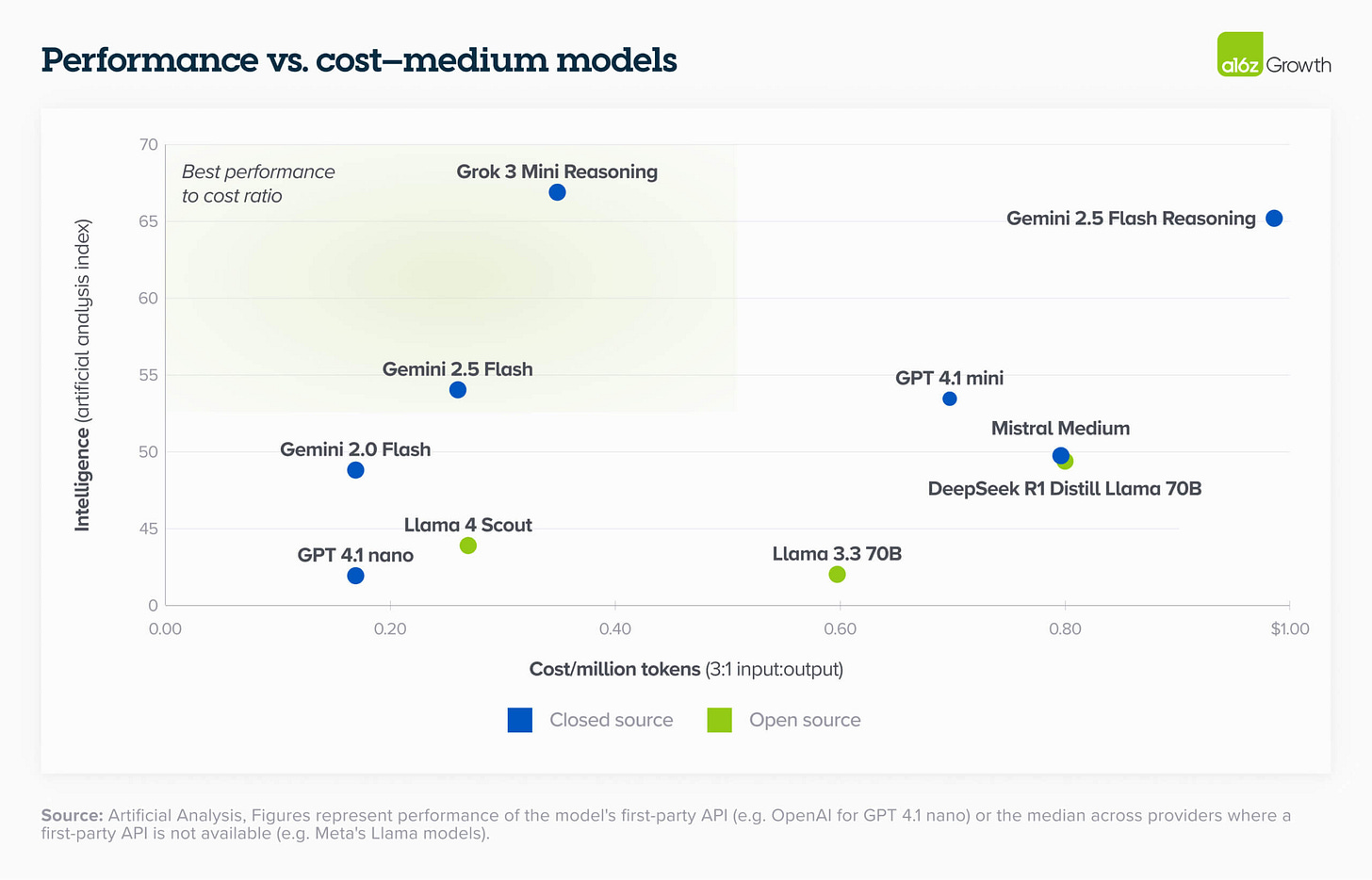

But here’s what’s interesting: it’s not just about having the best model or the cheapest tokens. 67% of AI startups report that infrastructure costs are their #1 constraint to growth.

The companies that survive aren’t waiting for costs to come down. They’re redesigning their entire approach to pricing.

Midjourney—Friction as Strategy

Midjourney started with what seemed like a generous bet: monthly subscription, unlimited usage.

Until the power users showed up.

A small percentage spun up thousands of high-res generations daily. Discord channels became slot machines for infinite variation. The compute bills exploded.

So Midjourney did something counterintuitive. They made two design decisions that are now textbook:

1. Shift from unlimited → usage-based boundaries

Plans now give a limited number of GPU minutes per month rather than open-ended output.

2. Inject friction intentionally

The UI isn’t optimized for bulk generation. It’s optimized for thoughtful prompting.

This wasn’t just cost control. It was customer selection:

Casual tinkerers: Fine with constraints.

Professionals: Will pay more because the output ties to real work.

Hobbyists who think they’re professionals: Will churn.

Midjourney didn’t just change pricing. They changed the behavior their product rewards.

Intercom—When Outcomes Beat Overhead

When Intercom launched FinAI, they did something most SaaS founders wouldn’t dare: abandoning their traditional $39 per-seat pricing for a per-resolution model, charging $0.99 per AI-resolved conversation.

The results? Within 6 months, they saw 40% higher adoption rates and maintained healthy margins despite the variable cost structure. One enterprise customer reported cutting their support costs by 60% while handling 3x more tickets.

The insight: customers were happy to pay for outcomes, not overhead.

Think about the traditional per-seat model for support software. If AI can handle tickets without human agents, why would a customer pay for seats they don’t need?

Intercom’s bet proved that aligning price with value beats protecting legacy revenue models.

The $5/Month Disaster

MapDeduce launched with a flat $5/month pricing model. Simple. Predictable. Fair.

Until reality hit.

They lacked granular usage tracking and relied heavily on third-party APIs like OpenAI, Google Cloud, and AWS S3. Their flat pricing model was a one-size-fits-all approach that failed to account for the fact that different users consumed vastly different amounts of compute.

Power users burned through their margins while the majority of light users subsidized them. But the subsidy only worked in one direction—the company was losing money on both ends.

This is the AI pricing trap: you can’t price on averages when your costs are exponential at the edges.

The Hidden Costs Nobody Talks About

API costs are just the beginning. Here’s the full picture in 2025:

One fintech’s chatbot burned $400/day per enterprise client on API costs alone. A financial AI spent $0.50 per request just on third-party data feeds before any processing began. A healthcare AI spent $1.20 per interaction on human verification—exceeding their entire revenue per query.

And that’s before hosting, customer support, or data storage.

The winners aren’t guessing at these numbers. They’re instrumenting everything from day one.

Pricing Models

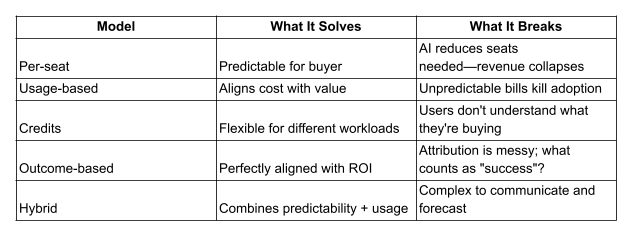

Most advice on pricing says: “Choose the model that fits your value metric.”

In practice, every model solves one problem and creates another.

Hybrid pricing surged from 27% to 41% of companies in just 12 months, while seat-based pricing dropped from 21% to 15%.

The shift tells you something: there is no perfect model. There’s only the model that works for your current stage.

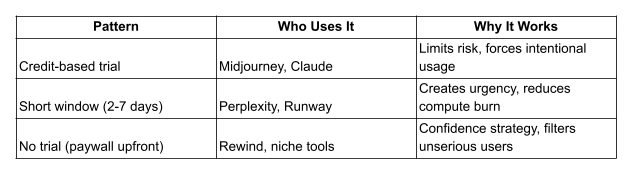

Free Trials Are Dead (Or Should Be)

Traditional SaaS used free trials as a conversion funnel:

14 days on the house

Take your time

Kick the tires

AI changed that math. Trials burn real compute. Some users will never convert. Some never intend to.

Three patterns are emerging:

Free trials now serve qualification, not marketing.

If you churn during a trial, the company assumes you weren’t the audience. Not the product.

Pricing as PMF Mirror

Here’s the philosophical shift AI forces:

Pricing used to trail PMF. AI flips that.

Pricing reveals PMF.

Look at the emerging segmentation:

Consumers: Want simple, predictable pricing

Hobbyists: Want cheap access and infinite experimentation

Teams: Want reliability and workflows

Professionals: Want speed, specialization, control

If everyone churns except one group? That’s your real market.

Not your landing page. Not your thesis deck. Not your “we serve everyone” fantasy.

Pricing pressure tests reality faster than any customer interview.

The Enterprise Blind Spot

Most AI pricing advice focuses on prosumer and SMB. But the enterprise game is completely different.

The “Build vs Buy” Reversal:

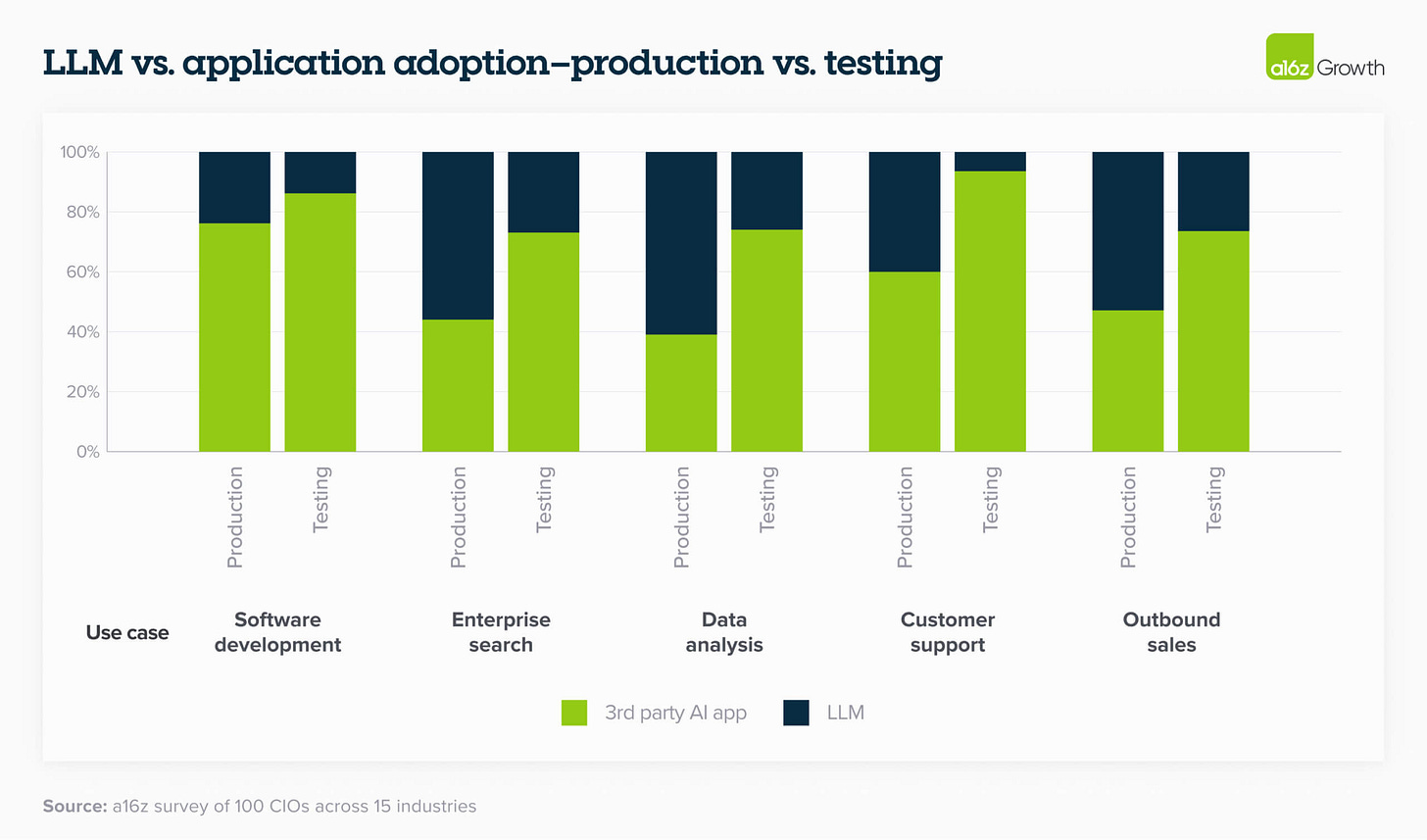

Early in the AI cycle, enterprises built their own applications on top of models. That’s flipping hard.

In a16z’s latest survey, enterprises are increasingly buying third-party AI applications instead of building internally. Why? Because in a space this dynamic, internally developed tools are difficult to maintain and frequently don’t give them a business advantage.

Over 90% of enterprises are now testing third-party apps for customer support—even companies that initially built in-house are switching to vendors.

One public fintech started building customer support internally but after reviewing third-party solutions, decided to buy instead. The constant optimization required to keep up with model improvements and cost changes is better handled by dedicated AI application teams than internal builders.

What this means for AI app companies:

If you’re selling to enterprise, your pricing needs to reflect the total cost of ownership advantage you provide versus internal builds. That includes:

Continuous model optimization as costs drop

Staying current with new model capabilities

Managing the complexity of multi-model deployments

Enterprise deals involve negotiated contracts, committed spend, and reserved capacity. Dedicated instances can run into six figures annually. Some organizations negotiate custom pricing tiers not reflected in public documentation, with volume discounts reducing costs by 20-40% from list prices.

And the deployment models vary wildly:

Cloud API: Pay per token, no commitment

Enterprise seat licensing: Annual/monthly per-user fees with SLAs

Dedicated capacity: Reserved throughput, predictable costs, often $50K-$500K+ annually

Hybrid deployments: Mix of cloud and on-premise, custom pricing

The companies winning enterprise deals aren’t just offering better models. They’re offering predictability in an unpredictable cost environment.

That’s worth paying for.

What Enterprises Actually Care About When Buying (It’s Not Just Price)

The enterprise buying criteria for AI has matured significantly. While accuracy and reliability were once the primary factors, enterprises now approach model selection with disciplined evaluation frameworks where security and cost have gained equal footing.

As one enterprise leader put it: “For most tasks, all the models perform well enough now—so pricing has become a much more important factor.”

This shift reflects increased trust in model performance and confidence that LLMs will be deployed at scale. But it also creates an opportunity: companies that can demonstrate predictable costs with strong security posture are winning deals over those with slightly better accuracy.

The prosumer-to-enterprise pipeline:

Strong consumer brands are translating into enterprise demand. Many CIOs noted their decision to purchase enterprise ChatGPT was driven by “employees loving ChatGPT. It’s the brand name they know.”

This prosumer-first adoption is fundamentally different from traditional enterprise software sales cycles—and it changes pricing strategy. If employees are already using the free version, the enterprise sale becomes about control, security, and predictable costs, not convincing them the product works.

The Compression Problem

Here’s what keeps CFOs up at night:

AI doesn’t just change pricing. It changes how many seats you need.

If AI can handle a sizable proportion of customer support, companies will need far fewer human support agents, and therefore fewer software seats. This forces software companies to fundamentally rethink their pricing models to align with the outcome they deliver rather than the number of humans that access their software.

Zendesk charges per support agent. But when AI resolves tickets, why pay for seats?

This is the “seat compression” crisis. And it’s forcing a wholesale rethinking of SaaS economics.

What Winners Are Doing Differently

The companies navigating this successfully share three behaviors:

1. They instrument everything from day one

You can’t optimize what you don’t measure. They track cost per user, cost per project, cost per model, cost per feature, cost per workflow. They get alerts when costs spike.

2. They change pricing quarterly, not yearly

Pricing is an operational system, not a marketing page. Model costs are dropping dramatically—OpenAI’s GPT-4o is 83% cheaper than GPT-4’s launch, and competitors like DeepSeek are undercutting by 90%. If your pricing hasn’t adjusted to these shifts, you’re either overpricing or undermonetizing.

3. They segment aggressively

Not everyone should be your customer. B2C AI struggles with 50-70% annual churn rates and low willingness to pay. The failure rate within three years sits at 63%.

The winners know exactly who they’re building for, and price accordingly.

Where AI Pricing Goes From Here

If you zoom out, the direction is clear.

AI pricing is converging toward a hybrid model:

Base subscription + usage metering + premium capability layers

Something like:

$X baseline access fee (stability for the vendor)

Metered compute (credits, tokens, minutes, actions)

Premium tiers for advanced models, dedicated capacity, or specialized features

And underneath that:

A segmentation strategy

An onboarding narrative

A customer filter

A moat built around workflow, not model access

Not everyone will pay for AI. Not everyone should.

The winners won’t be the companies with the best models or the cheapest tokens. They’ll be the ones who know exactly who they’re building for, and price accordingly.

What’s Next

This is Part 1 of a series on AI economics. Coming next:

Part 2: Enterprise AI Pricing (how land-and-expand breaks in the AI era)

Part 3: When AI Pricing Goes Wrong (autopsy of failed models)

Part 4: Building a Pricing Operations Stack (the tactical playbook)

Want these delivered straight to your inbox?

Eligibility: Pre-seed and seed-stage startups, new to Framer.

The dynamic pricing point really nails it. What's intresting is how this mirrors cloud infrastructure's evolution a decade ago when everyone thought reserved instances were the answer untill spot pricing forced a completly different optmization mindset. The real challenge now isn't just metering usage but predicting which customer behaviors signal future value versus future bleed.